Award-winning PDF software

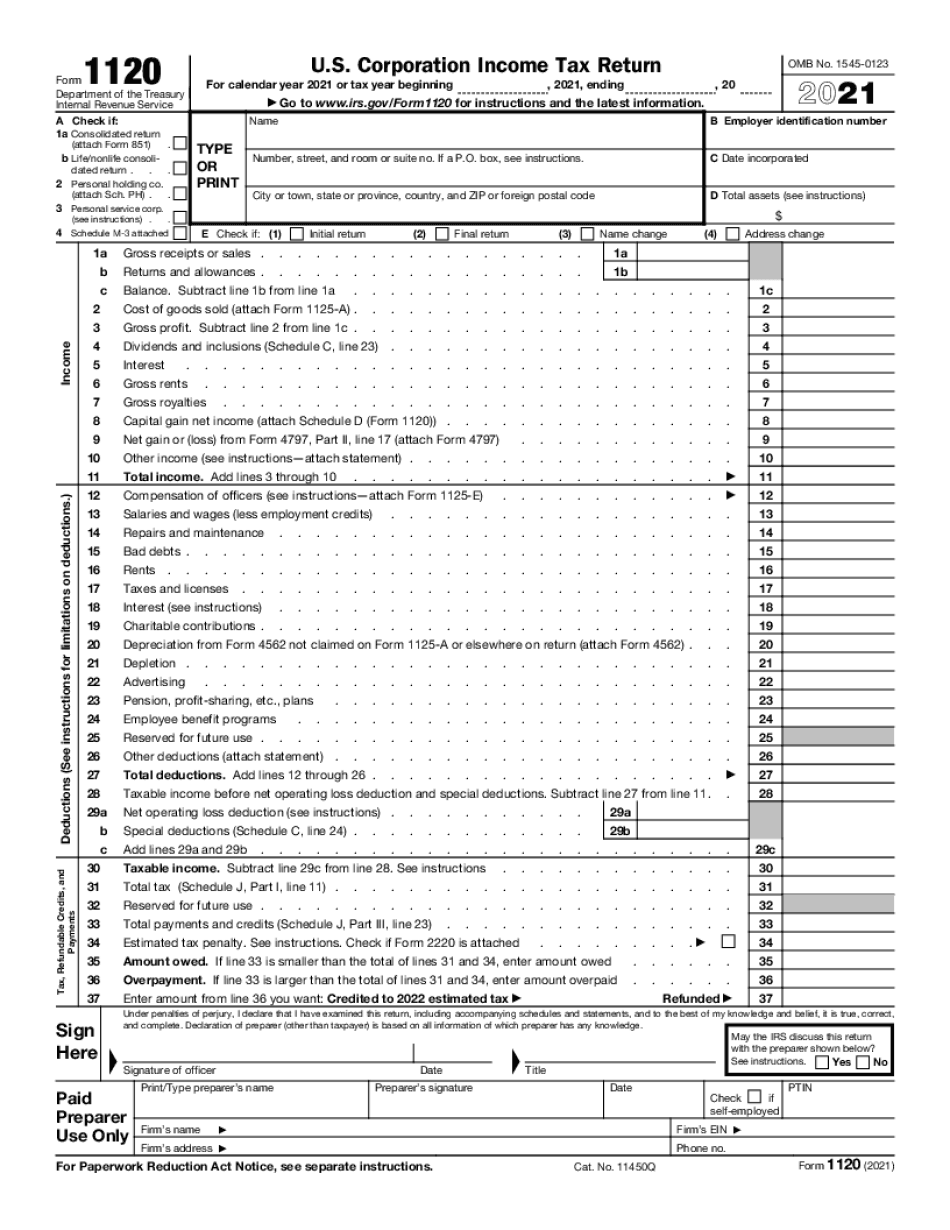

How to prepare Company Tax Return

1

Complete the papers

Undergo all the fields inside our professional editor. Put in the specified details in highlighted places and double-check it.

2

Signal the shape

Click the Signature area (if available) or pick the Sign tool through the top toolbar. Create the electronic signature with your desired way.

3

Keep or send out the template

Whenever your Company Tax Return is completed, pick Done to enter the export menu. Keep your record within a needed format or send it towards the recipient right from the service.

Get Company Tax Return and streamline your day-to-day file management

- Locate Company Tax Return and start modifying it by simply clicking Get Form.

- Begin completing your form and include the data it requires.

- Benefit from our extended modifying toolset that permits you to add notes and make comments, if needed.

- Review your form and double-check if the information you filled in is right.

- Swiftly correct any error you have when changing your form or return to the earlier version of the document.

- eSign your form easily by drawing, typing, or taking a picture of the signature.

- Save changes by clicking Done and download or send out your form.

- Submit your form by email, link-to-fill, fax, or print it.

- Select Notarize to perform this task on your form on the internet using our eNotary, if necessary.

- Securely store your approved file on your computer.

Editing Company Tax Return is an easy and intuitive procedure that requires no prior coaching. Get everything that you need in a single editor without constantly switching between different platforms. Locate more forms, complete and save them in the file format of your choice, and improve your document management within a click. Just before submitting or delivering your form, double-check information you provided and swiftly correct mistakes if necessary. In case you have questions, contact our Support Team to help you.

Video instructions and help with filling out and completing Company Tax Return